Have we forgotten productivity in pursuit of sustainability?

These notes have been put together to support the conversation around investing in agriculture and sustainability. The starting point is productivity given that it underpins the ability of the sector to thrive.

“Productivity isn’t everything, but in the long run, it is almost everything”

Paul Krugman

“A sectors ability to thrive over time depends almost entirely on its ability to improve productivity”

Paul Krugman (adapted)

Growth Farms is an Australian investment management company which for the past 25 years has focused on buying farms for investors and enabling them to reach their operational potential by driving gains in productivity.

These notes have been put together to support the conversation around investing in agriculture and sustainability. The starting point is productivity given that it underpins the ability of the sector to thrive. Interestingly, in Australia, agriculture is one of the stand-out sectors when it comes to high rates of productivity over the long term.

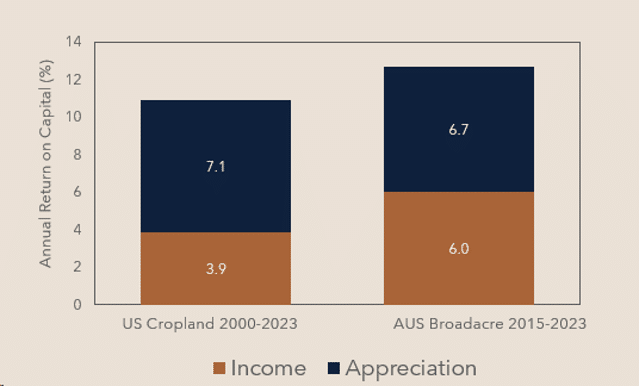

Where we make money in Agriculture

The bar chart below shows data from the US and Australia which illustrates that at least 50% of investment returns come from capital appreciation. However, we don’t often think about why that appreciation occurs.

Source: NCREIF, ANREV 2023

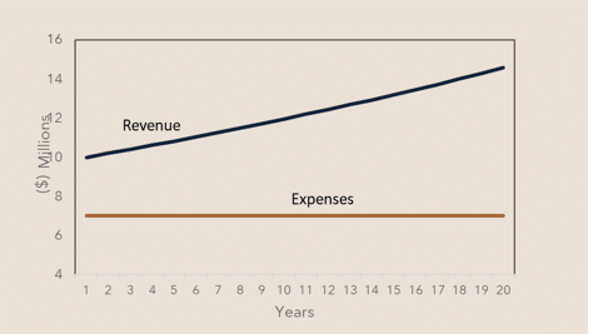

Productivity drives margin expansion

As a simple example take a farm which has total income of $10m p.a. and flat expenses of $7.5m p.a. If we assume 2% annual gain in productivity, all coming on the revenue or output side there is a a significant increase in margin over time – from $2.5m to over $7m – an increase of nearly three fold over twenty years.

Source: GF analysis 2023

Margin expansion drives land values

In reality we don’t see margins (profits) continue to increase at those rates. What happens is that the value of the land increases so return on capital stays somewhere around constant. It is this margin expansion which drives land values. Looking at the 2% productivity gain in the table below we can see that it converts to a 4.6% CAGR. This is in real terms – it is higher if in nominal terms which is how most numbers are reported. We can also see that without productivity gains there are no capital gains and the investment case for agriculture falls over.

| Prod Gain % | CAGR % |

| 0% | 0% |

| 0.50% | 1.4% |

| 1.0% | 2.6% |

| 1.5% | 3.7% |

| 2.0% | 4.6% |

| 2.5% | 5.5% |

| 3.0% | 6.3% |

Source: GF analysis 2023

What drives the productivity?

There are three key factors that drive productivity:

1. Capital investment (replacing labour)

2. New technology – two different sources:

a) Inside the sector e.g. precision ag, genetic improvement (R&D public and private)

b) Outside the sector e.g. drones

Each of these account for about half of the contribution to productivity.

3. Scale – size of the business is partly a consequence of productivity but also drives it.

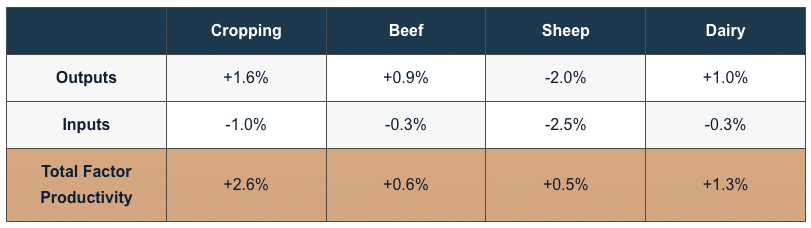

Not all sectors perform equally (1978 – 2021)

At a more granular level it is important to recognise that not all sectors perform equally as demonstrated in the table below. Cropping has performed well over the last 43 years whereas sheep and beef have lagged which in the case of sheep at least, partly explains the increase in crop area in the mixed farming regions and the decline in the national sheep flock. The failure of the sheep industry to achieve substantial productivity improvements simply means it is less competitive than cropping. Note these comments apply at the sector level – what happens at the individual farm level will vary widely.

Source: ABARES, Australian Agriculture Productivity 2021-22

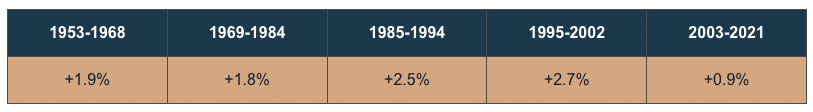

Has productivity in agriculture peaked?

However the key question is – has agricultural productivity peaked?

Sources: ABARES 2023, Wang 2006

Growth Farms’ view is that while it has been variable and recently has been lower than the long term trend, this doesn’t mean it has peaked. It may well be that the next wave of productivity is on its way driven by biotech and agtech – robotics, data analysis etc. Time will tell.

The other question is climate change – which potentially will have a fundamental influence on what productivity might look like in the future.

Which brings us to our main point which is that -

Sustainability should be seen as a component of productivity not an end in itself.

If we think long term it is impossible to be truly productive and not be sustainable.

Thinking about carbon as an example ..

On every farm we manage we aim to increase soil carbon because it makes the farm more productive, more resilient, and more profitable.

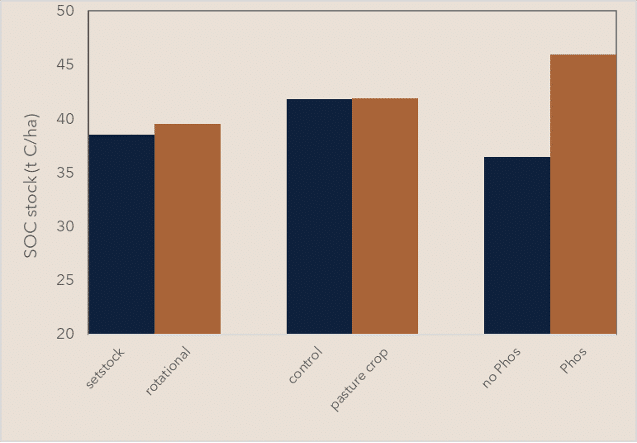

Currently we see that real value of carbon is in its productive capacity rather than the theoretical monetary value ascribed to it via carbon markets. It is an asset that we aim to build on over time. How you choose to build that soil carbon is important. There is much talk and many claims of various grazing systems and their influence on soil carbon, but evidence shows that the key driver is soil fertility in medium to high rainfall zones, that is, it is about growing more pasture, not about what grazing method you choose to use to harvest the pasture.

Source: NSW Government Industry and Investment, A farmers guide to increasing soil organic carbon in pastures 2010

Biodiversity markets are not here yet but they are coming …

Despite the fact that biodiversity markets are in their infancy, for the past two decades we have been cultivating biodiversity due (again) to the productivity, but also aesthetic and environmental benefits they offer rather than theoretical monetary value that they may provide in the future. We have frequently identified and actively preserved sites of value e.g. endangered vegetation landscapes and rare or endangered species.

Climate change and productivity

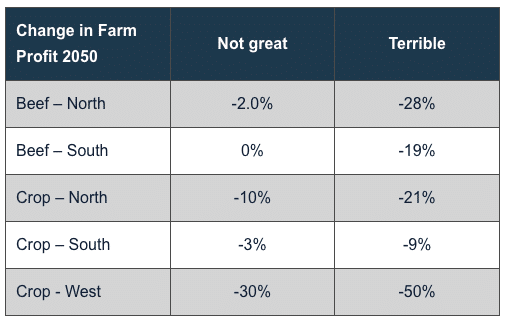

When we’re thinking about mitigation of climate change risks and driving gains in productivity, starting to look at portfolio construction from both a sector and regional perspective is critical. The table below illustrates the variability using two different scenarios of increasing GHG emissions. The first moderate and the second more aggressive increase in GHG emissions. While these are forecasts, they provide a best estimate of the possible affects and the key message is that some sectors and some regions face much greater risks than others. Important to note this data focuses on profit which is more sensitive to change than productivity.

Source: ABARES Insights “Snapshot of Australian Agriculture" March 2023

So where does this leave us?

When making investment decisions there are several key questions to consider in order to understand past, current and future state:

• Does the country have a track record of improving productivity?

• Does the sector have a track record of improving productivity?

• Are gains being achieved sustainably or by unsustainable practices such as deforestation or overfarming?

• Does the operating environment underpin further productivity gains e.g. R&D, education, competition?

• What will be the possible affects of climate change on productivity?

For further information or questions please contact us at info@growthfarms.com.au